Tsp withdrawal calculator

Copy and paste this code into your website. Exceptions to the 10 Percent Early Withdrawal Penalty posted on 08232022.

Tsp Contributions And Funds Youtube

Special agents are not required to put additional funds into their TSP.

. The regular 10 early. Exceptions to the 10 Percent Early Withdrawal Penalty. The key question that will likely determine your selection is.

Tips for Successful Retirement Investing. TSP Investors Handbook New 7th Edition. TSP Investors Handbook New 7th Edition.

However any investment the agent makes into the plan is matched by the government up to 5 percent of the agents salary. One of the options you have when you use the TSP withdrawal calculator available through the Thrift Savings Plan website is to better understand what TSP Annuity options are available to you. At age 56 monthly payments begin at 108885.

Do I have to report TSP withdrawal on taxes. What is the impact of early withdrawal from my 401k. And hopefully not run out.

Over the last several years the interest rate has been as high as 3125 November 2018 and as low as 1375 September 2016. FERS Retirement Guide 2022. It is important to keep your tax.

Also you may owe income tax in addition to the penalty. The option you may pick a full withdrawal would be conducted using TSP-70 form or you may choose a partial TSP withdrawal. Thrift Savings Plan TSP Withdrawals are filed directly with the TSP Service Office at least 30 days after retirement.

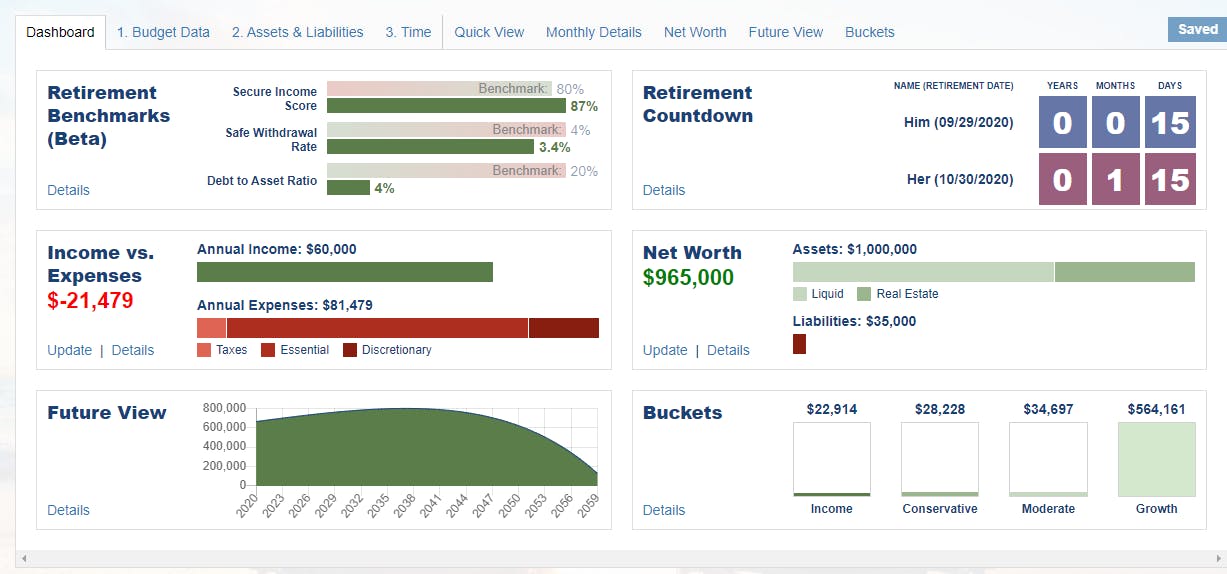

Im self-employed how much can I contribute to a retirement plan. TSP Loan High-3 Average S alary- TSP Contributions TSP Withdrawal- FEGLI Premiums TSP Projected Account Balance - Social Security Benefit EnrollmentsChanges. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees.

You must take your first Required Minimum Distribution RMD by April 1st of the year following either the year you turn age 72 or the year you retire whichever is later. The amount of taxes withheld on TSP withdrawal varies depending on how you withdraw the money. Tsp or 24 grams g of added sugar daily and men consume no more than 9.

Use our FERS Retirement Calculator and CSRS Retirement Calculator to estimate your monthly annuity and calculate what your federal tax burden will be before you leave by using OPMs tax calculator. Your retirement accumulation may become simply by saving a small percentage of your salary each month in your TSP plan. The following COVID information was for 2020 Returns.

The early withdrawal penalty for a traditional or Roth individual retirement account IRA is 10 of the amount withdrawn. Several estimator s and calculator s are available so you c an perform what-if scenarios co ncerning your. The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½.

All withdrawals are subject to a mandatory 20 federal income tax withholding unless the funds are transferred directly to a traditional IRA. Learn about possible sugar detox symptoms and how to manage sugar withdrawal. Before choosing consider your risk tolerance age and the amount youll need to retire.

What Is a Thrift Savings Plan TSP. To explore annuity estimates based on a different type of annuity purchaseor an annuity purchase combined with other withdrawal optionsyou can use the TSP payment and annuity calculator. When a 401k Hardship Withdrawal Makes Sense.

The GRB Platform provides you with the ability to make. â œDistribution â œ payment â and withdrawal all mean the same thing. We look beyond the conventional wisdom to craft a personalized investment withdrawal amount based on your age when withdrawing from a 401k IRA TSP or brokerage account.

Taxes can be significant in retirement. Submitting a Withdrawal Request - Log into Your TSP. IRA TSP or brokerage account.

Withdraw all or some of your TSP funds You could elect a partial withdrawal a series of monthly payments a full withdrawal or a mixed combination of withdrawal options. If you withdraw money from your retirement account before age 59 12 you will need to pay a 10 early withdrawal penalty in addition to income tax. When RMDs kick in at 70 ½ the monthly amount drops to 124551.

I used the calculator making the following assumptions. What Is a Required Minimum Distribution RMD. TSP G Fund F Fund C Fund S Fund I Fund.

The government invests an amount equal to 1 percent of the employees salary into the account. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve. Use this calculator to estimate how much your plan may accumulate for retirement.

There is a big difference though in how much is withheld from your TSP payments for federal income tax. In 2020 Americans who experienced adverse financial consequences due to the pandemic were allowed to withdraw up to 100000 without having to pay a 10 early withdrawal penalty. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve.

As a result of the June 2020 CARES Act retirement account holders affected by the Coronavirus could access up to 100000 of their retirement savings as early withdrawals penalty free with an expanded window for paying the income tax they owed on the amounts they withdrew. The TSPs Retirement Income Calculator was used for these figures. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees.

This is similar to a 401k. 401k plans typically offer mutual funds that range from conservative to aggressive.

Best Retirement Calculator Simple Excel Spreadsheet Youtube

Tsp In Tax Season

Want Clarity So You Can Retire Watch This Video Csrs Service History And Catch 62 To Exchange Conf Federal Retirement Retirement Benefits Investment Advisor

4 Things To Consider Before Moving Your Tsp Savings Usaa

Retirement Calculator Spreadsheet Retirement Calculator Budget Template Simple Budget Template

Retirement Calculator When Can I Retire Retirement Budget Calculator

How To Calculate Your 21 Day Fix Calorie And Container Level 21 Day Fix Diet Beachbody 21 Day Fix 21 Day Diet

Retirement Withdrawal Calculator

Retirement Savings Calculator

Tsp4gov Want To Design A Savings Plan That S Right For You Our Calculators Can Help Https Www Tsp Gov Planningtools Index Html By Thrift Savings Plan Facebook

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Start Planning With Our Fers Retirement Calculator Retirement Benefits Institute Retirement Calculator Retirement Benefits Retirement Planner

Calculator Retirement Plan Withdrawal Milspouse Money Mission

Retirement

Easy Egg Fried Rice Is Made With Just A Few Ingredients This Better Than Takeout Dinner Is Easy In 2022 Cheese Burger Soup Recipes Frozen Salmon Easy Orange Chicken

How To Calculate Provident Fund Online Calculator Government Employment

Fers Retirement Calculator Youtube